How to Survive Price Inflation as a Small Business

Get proactive and stay ahead of price inflation. Here are seven tips to survive inflation as a small business.

As if the past few years haven’t been challenging enough, now small businesses are dealing with price inflation.

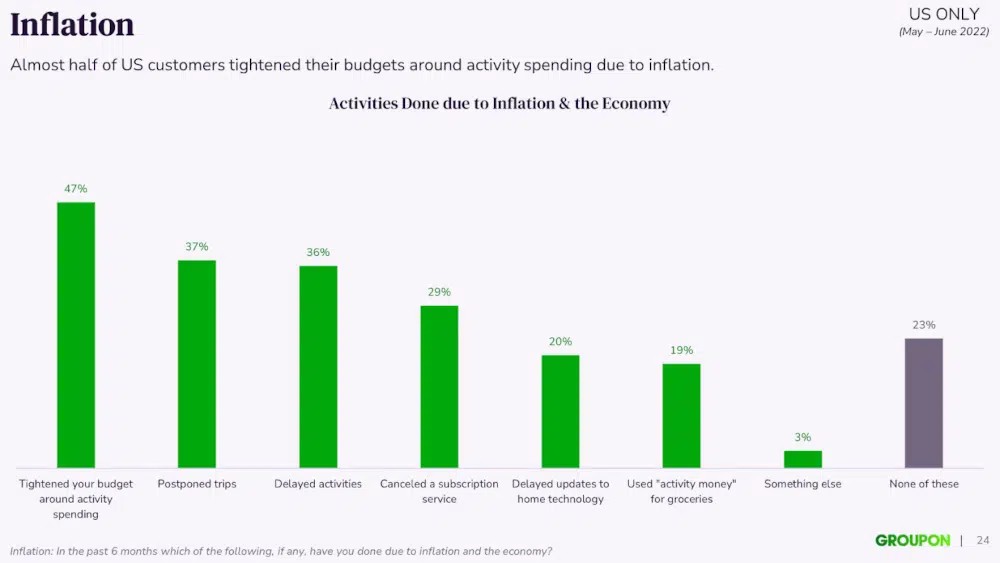

In 2022 so far, the U.S. experienced the highest month-over-month U.S. dollar inflation rates since 1982.1 This has led to nearly half of U.S. consumers (48%) tightening their budgets around activity spending.

Ninety-one percent of small-business owners say current economic trends are having a negative impact on their business.2 But does this mean the end of small business?

Absolutely not!

Dramatic price inflation won’t last forever; some believe it will taper off in mid-2023.3 Until then, you can survive inflation with a little innovation, and here’s how:

- Know Your Profits and Losses

- Cut Costs

- Lower Supply Chain Risk

- Improve Productivity

- Focus on Employee Retention

- Raise Prices

- Restructure Your Offerings

7 Tips for Surviving Price Inflation as a Small Business

1. Know Your Profits and Losses

During these times, you can expect tighter profit margins. But you’ll want to review your financial statements to know exactly where those margins stand on your products and services today – that picture may have changed in the past months.

Commit to doing this exercise at least quarterly so you can pivot as needed.

2. Cut Costs

The majority (92%) of small-business owners say the cost of supplies or services they need has increased since the pandemic hit (71% saw at least a 20% increase).4

Cutting costs is one of the first things businesses do to improve cash flow. But how?

Here are some ideas:

- If one of your offerings isn’t helping your bottom line anymore, put it on hold for now. Put your efforts into what is working.

- Look for creative ways to save on the things that cost the most. For example, a restaurant might make its own soup base instead of buying a pre-packaged item. Or a salon might switch product suppliers to save money or buy in bulk if possible.

- Find out if you can negotiate leases, renegotiate contracts and/or restructure current debts. Most people want to come to a mutually beneficial solution.

3. Lower Supply Chain Risk

When you lower supply chain risk, you can grow revenue. Deloitte found that the majority (79%) of businesses with superior supply chain management saw above-average revenue growth.5

Here are tips on how to manage your supply chain:

- Understand the demand for certain offerings and optimize your supply chain accordingly.

- Know how to evaluate suppliers and take the time to build good relationships.

- Have backup options at all times — just in case.

- Continuously improve your supply chain; it’s not a “one and done” thing.

- Consider local suppliers to lower risk and help your community.

- Outsource supply chain management to ultimately save more money.

4. Improve Productivity

Take stock of all the tasks your business does on a daily, weekly and monthly basis. Now, identify where you can invest in technology or automation to track and improve productivity and free up some of your resources.

Usually, you can automate tasks that don’t need a high degree of expertise. This allows you to focus your time on what matters. You can reduce labor costs in the process, too.

Where can technology help? Everything from digital appointments and reminders, bookkeeping, marketing, food prep automation and much more.

5. Focus on Employee Retention

Forty-five percent of small businesses say that finding and retaining employees is the biggest problem they face.6

As the cost of living rises, employees need more money for food, gas and living, and that’s putting a strain on the small-business payroll.

Just some of the ways small businesses are responding to labor issues include:

- Offering incentives to retain employees, like employee benefits, gas cards to help with transportation and other creative strategies.

- Deciding that the owners will take a pay cut for a period of time.

- Letting go of certain staff to keep critical employees and offer them higher wages.

- Investing in automation to help fill the gaps of fewer resources.

6. Raise Prices

If you’re operating lean and profit margins are still not great, it’s time to adjust prices. Sixty-seven percent of small businesses report raising prices between Q1 2021 and Q1 2022.7

It’s not always easy. Business owners often feel bad about passing costs to customers, and also worry that they will lose clients in the process.

While you will likely lose a small percentage of people, it can lead to retaining more ideal clients in the long run.

But be strategic about how you do it. One big price increase that allows you to adjust for future rising costs may work better than several little price hikes over time.

The good news is that many people want to support small businesses during tough times.

Research shows that 56% of consumers prioritize small business purchases during high price inflation, and 30% say they want to support small businesses over big brands because they have more struggles and fewer resources.8

7. Restructure Your Offerings

Come up with offerings that add more perceived value and also bring in more revenue to the business.

Here are some ideas:

- Focus on what you do well. Warren Buffett says that the best thing you can do during inflation is to be “exceptionally good at something.”9 Strip your offerings down to focus on what you do well. For example, a restaurant might pare down its menu to only a few, exceptional dishes and use seasonal ingredients to cut costs.

- Present your offerings in new ways. Restructure your offerings in a new way by bundling certain services and/or products together. Or, create a membership program that brings in a certain amount of revenue you can count on each month.

- Think about added value. Your customers may not mind paying more if you can enhance their experience. Maybe you commit to better customer service, or offer little perks that don’t cost much. For example, a salon might throw in a scalp massage and hot towel treatment while customers are at the shampoo station.

- Launch new revenue streams. What new offerings can you launch that are complementary to what you already do? Maybe a delivery service? Or a new beauty treatment?

If we’ve learned one thing over the past few years it’s that small-business owners are resilient. Think about how you can get ahead of price inflation in a way that’s a win for both you and your customers. Learn how to sell on Groupon for more ways to increase your customer base and revenue.

Sources:

- https://www.business.org/finance/accounting/effects-of-inflation-on-small-businesses/

- https://www.goldmansachs.com/citizenship/10000-small-businesses/US/infographics/april2022/index.html

- https://www.forbes.com/advisor/personal-finance/when-will-inflation-go-down/l

- https://www.business.org/finance/accounting/effects-of-inflation-on-small-businesses/l

- https://www2.deloitte.com/us/en/pages/operations/articles/supply-chain-leadership.htmll

- https://www.goldmansachs.com/citizenship/10000-small-businesses/US/infographics/april2022/index.htmll

- https://www.uschamber.com/small-business/special-report-on-inflation-and-supply-chain-shocks-on-small-businessl

- https://martechseries.com/sales-marketing/marketing-automation/new-data-reveals-amid-high-inflation-consumers-want-to-support-small-businesses/l

- https://www.cnbc.com/2022/05/02/this-is-warren-buffetts-simple-advice-for-periods-of-high-inflation.htmll

Ready to join the 1 million+ merchants who've worked with Groupon?

Subscribe for Updates

© 2022 - 2026 Groupon, Inc. All Rights Reserved. GROUPON is a registered trademark of Groupon, Inc.